The Ordinals craze has struck again: the average fee for a Bitcoin transaction recently hovered around $40, and hundreds of thousands of transactions are waiting to be processed due to mempool congestion. An opportunity to test the scaling of the Bitcoin network should it be massively adopted?

Bitcoin fees are returning to the level of a year and a half ago

According to data from BitInfoCharts, average transaction fees (fees) on the Bitcoin blockchain were around $40which has not happened since April 2021.

Evolution of average transaction fees on Bitcoin in 3 years

Currently, the increase in bitcoin fees is due to the frenzy surrounding the inscriptions of Ordinals, compared to the poorly understood non-fungible tokens (NFT) way. Immutable digital artefacts, signs have been in the news a lot since they became popular with the general public last May, when the BRC-20 standard appeared.

👉 To understand everything – What are Bitcoin Ordinals and how are they different from NFTs?

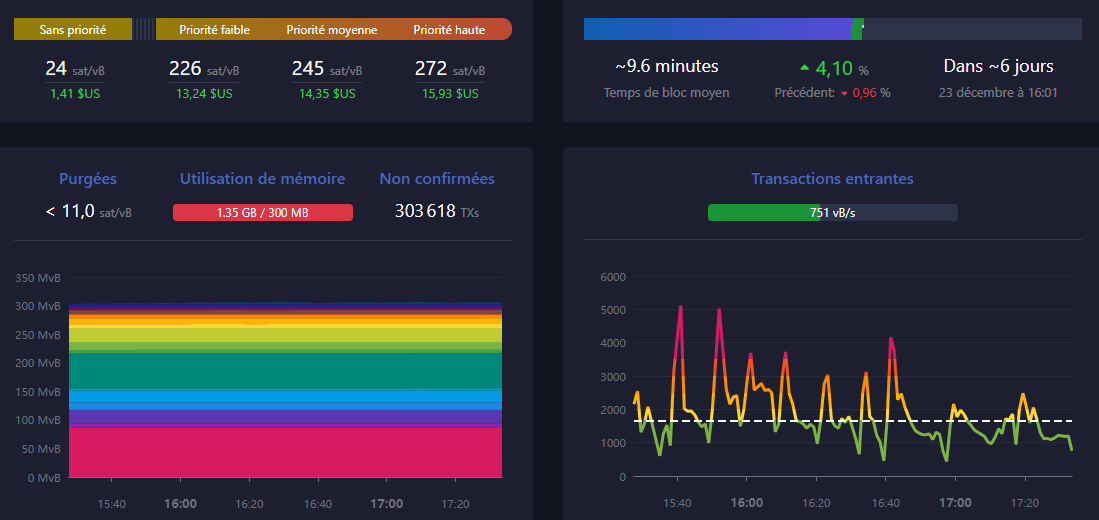

According to data from mempool, there are currently just over 300,000 transactions waiting to be processed on Bitcoin. At the same time, many network users are forced to do so pay higher fees for processing their transactions to miners.

Overview of pending Bitcoin transactions

Data that directly fuels the already lively debate about Ordinals registrations, some feel that this innovation goes against the original purpose of Bitcoinwhere others defend it by arguing that it is nothing else than the ingenious use of Taproot and SegWit updateswhich made it possible to significantly expand the block size on Bitcoin.

The debate, which also created a real split in the community, to the extent that Luke Dashjr, one of the main developers of Bitcoin, described the registrations as a “bug” and blocked the possibility of creating them from Bitcoin nodes, software competing with Bitcoin Core, which he developed himself.

Feel Mining: generate passive income with your cryptocurrencies

BTC miners, the first to rejoice in mempool congestion

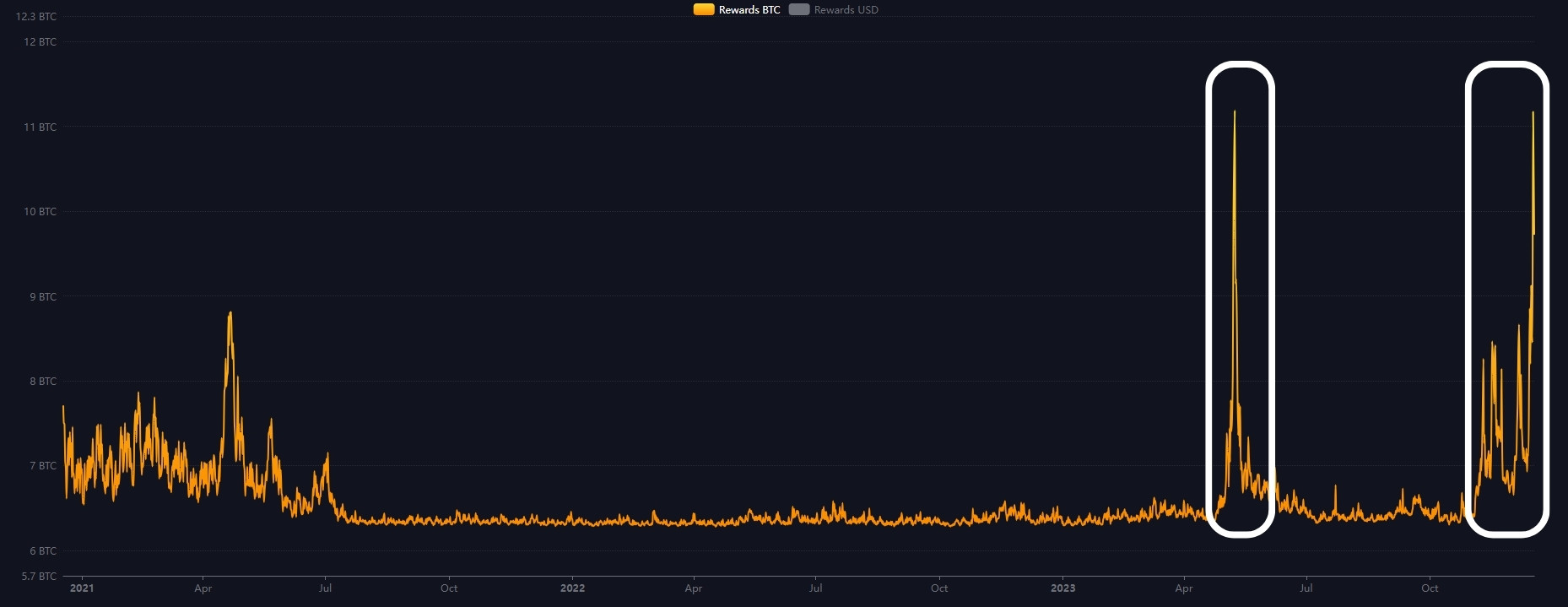

Although the increase in fees will naturally affect Bitcoin users who want to trade small amounts, BTC miners are the first to be pleased by mempool overload. The higher the number of satoshis per vByte (sat/vByte), the higher the rewards for each mined block will be in parallel:

Bitcoin miner mined block reward development in 3 years (in BTC)

So if we keep in mind that Bitcoin miners keep the network alive, it’s completely understandable that they are in favor of processing Ordinals registrations from a purely profit point of view.

👉 On the same topic – Ordinals: Sotheby’s first registration sale exceeded expectations

This observation could register a current mempool overload as a real-world test of what could happen if Bitcoin saw mass adoption.

Adam Back, CEO and founder of Blockstream, noted that whatever happens, we can’t stop “ JPEG on Bitcoins » and that we should therefore rather see it as an opportunity” stimulate layer 2 adoption “and” force innovation “.

You can’t stop JPEGs on bitcoins. complaining will only make them do it more. they try to stop them and they do it in worse ways. high fees drive Layer 2 adoption and force innovation. so relax and build things.

— Adam Back (@adam3us) December 16, 2023

Hodlonaut, a well-known figure in the Bitcoin ecosystem, supported this view (he also incidentally characterized the inscriptions of Ordinals as absurd), adding that it was all just a glimpse of the future, and that it was necessary to understand that “ scaling is not done at layer 1 ».

Whether you are for or against registrations, one thing is certain: they at least have the credit of testing many blockchainsas was also recently seen on the Arbitrum side, whose sequencer broke down at 1h30 2 days ago.

Cryptoast Research: Stay one step ahead of the crypto market

Sources: mempool, BitInfoCharts

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This site may contain investment-related assets, products or services. Some links in this article may be affiliate. This means that if you purchase a product or register on a site from this article, our partner will pay us a commission. This allows us to continue to offer you original and useful content. Nothing will happen to you and you can even get a bonus using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this site and cannot be held responsible, directly or indirectly, for any damages or losses incurred after using the goods or services highlighted in this article. Investments related to cryptoassets are inherently risky, readers should do their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

recommendations of the AMF. There is no guaranteed high return, a product with high return potential involves high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose some of these savings. Do not invest unless you are prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notice pages.