The United States Federal Reserve (FED) released its last monetary policy decision of the year and pleasantly surprised financial markets by confirming high finance expectations for the end of the monetary policy tightening campaign. It is clear that the FED pivot is certain for 2024 and it is a supportive factor for Bitcoin (BTC) and the crypto market.

Disinflation without recession, the Fed’s bet for 2024

This week is the last busiest week before the end of the year in terms of fundamentals. Updated US inflation, Markit PMIs (leading indicators most respected in the market), important US economic aggregates such as retail sales (household consumption barometer, 70% of US GDP) and especially the latest monetary policy decisions of leading central banks.

All investors’ attention was focused on the Federal Reserve System of the United States (FED), which updated its macroeconomic expectations on Wednesday, December 13 at 20:00. Jérôme Powell’s FED has a pleasant surprise for the market confirming that the monetary policy tightening campaign launched in January 2022 to fight inflation is now over (the FED terminal rate is definitively set at 5.50%).

The very favorable reaction of risky market assets (the S&P 500 index is again in contact with its historical record and the DAX is making new historical records) was mainly caused by the new projections of the FED for the year 2024. The FED thus confirmed that it is considering 3 rate cuts next year, in short, the FED’s pivot is now (almost) certain for 2024.

In the table below, you can read that the FED expects disinflation without an economic recession for the years 2024 and 2025, which is the ideal scenario for risky assets on the stock market.

Table proposed by the Federal Reserve System (FED) showing the US central bank’s macroeconomic expectations for 2024 to 2026

XTB: a complete broker for investing

The consequences of the stock market are logical :

- Continued decline in market interest rates in the United States and Europe (strong recovery in the bond market);

- The US dollar’s continued downtrend against a basket of major currencies;

- Continued bullish recovery in stock indexes, still led by US tech stars and AI in particular.

These cross-asset factors have a positive effect on the price of cryptocurrencies due to correlations, thus the price of Bitcoin can rebound on the support at $40,000.

👉How to buy Bitcoins (BTC)? Find our step-by-step guide

The uptrend in Bitcoin price remains well constructed on a technical level

So the price reaction of bitcoin and altcoins was bullish after the Fed. Thus, BTC rebounded on the $40,000 support and Ether (ETH) on the $2160 support. As long as these two levels are maintained based on the daily close, then the trend is bullish. The move up is well constructed, with alternating bull impulses and lateral pause phases.

Trade Republic: earn 4% interest per year on uninvested cash

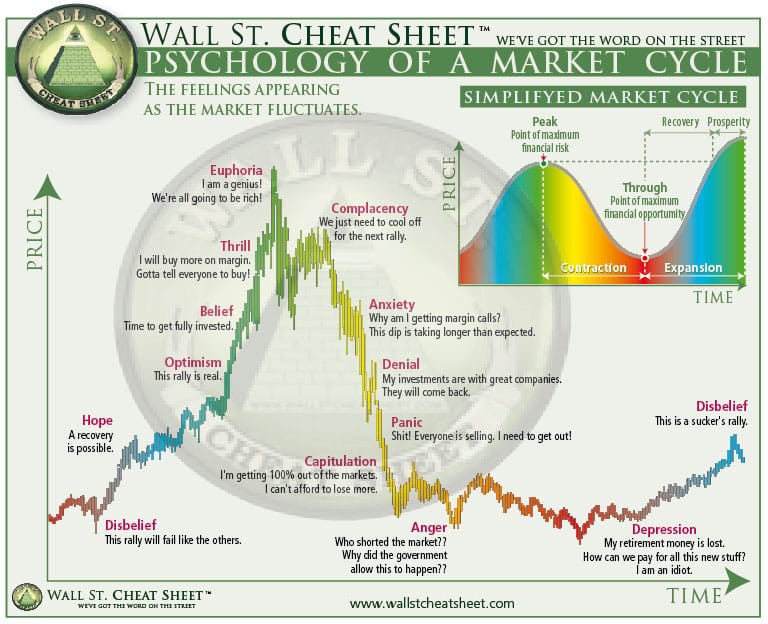

The uptrend is still driven by institutional flows, individual investor searches for “bitcoin” on Google Trends remain deadlocked. This is confirmation that the market is still between denial and hope regarding the psychological cycle of an uptrend reversal.

An infographic that illustrates the common psychology of traders over a complete market cycle

👉How to buy cryptocurrencies in 2023?

Find Technical Analysis by Vincent Ganne Cryptocurrency research, the perfect place to successfully invest in cryptocurrencies. You will learn how to position yourself at strategic price levels, find investment opportunities and predict price movements. Join us and take care of your crypto investments.

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This site may contain investment-related assets, products or services. Some links in this article may be affiliate. This means that if you purchase a product or register on a site from this article, our partner will pay us a commission. This allows us to continue to offer you original and useful content. Nothing will happen to you and you can even get a bonus using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this site and cannot be held responsible, directly or indirectly, for any damages or losses incurred after using the goods or services highlighted in this article. Investments related to cryptoassets are inherently risky, readers should do their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

recommendations of the AMF. There is no guaranteed high return, a product with high return potential involves high risk. This risk taking must be consistent with your project, your investment horizon and your ability to lose some of these savings. Do not invest unless you are prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notice pages.